Are you selling your house in Spain?

While it isn´t our intention to discourage you from selling your property in Spain, it is important to keep in mind this could be a very long-term process.

In fact, in most cases, it takes nearly a year to sell a property in our country.

The length of the process depends, of course, on the area the property is in, the price asked for and the commitment and abilities of the real estate agent selected for the task.

Fortunately, once a buyer has been found, the process tends to speed up considerably.

The following guide will help you clarify and understand what´s expected of you every step of the way.

A brief guide to selling a property in Spain and how we can help you.

Power of attorney:

If you are planning on selling your property in Spain, you don´t have to be present in the country for the entirety of the process.

Once you grant us the power of attorney, the team of legal experts at Fuster & Associates will be able to represent you throughout the process and help you complete the sale of your property.

In Spain, you can have your power of attorney signed at any Notary public.

If you are abroad and don´t intend to travel to Spain before the sale, you can have it signed at a nearby Notary and have the document Apostilled.

Previous owner’s title Deeds:

One of the first things you´ll be asked to do before selling your property in Spain is to prove its ownership.

Property ownership in Spain is certified by a Title Deeds, a public document known in Spain as “Escritura”.

Your “Escritura” will have to be authorised by a Notary and registered with the Land Registry.

You will need to retain a copy of your Title Deeds, or at least the most relevant details in it to be sent to potential buyers.

This information confirms your ownership of the property and proves that all processes have been done in accordance with Spanish law.

Please bear in mind that it´s not compulsory for you to provide the buyer with a copy of the Escritura in order to complete a sale.

However, to avoid complications it is always best to keep a copy of the document handy to show buyers when they are conducting their legal searches.

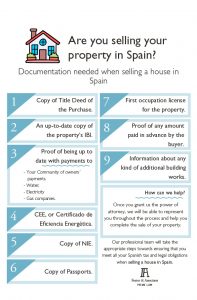

Documentation needed when selling a house in Spain:

Should you trust Fuster & Associates to complete the sale of your property in Spain, our team will require all the following documents in order to arrange the completion:

-Copy of your Title Deeds or the most important information pertaining to this document,

-The property’s CEE, or Certificado de Eficiencia Energética (energy efficiency certificate or EPC),

–Your NIE, or Número de Identificación de Extranjero (Foreign Resident Identification Number),

-Copy of your Passports

–First occupation license for the property

–An up-to-date copy of the property’s IBI receipt (Council Tax)

–Proof you are up to date with your Community of owners´ payments

-Proof of being up to date with payments to water, electricity and gas companies. A copy of the most recent bills is required.

–Proof of any amount paid in advance by the buyer.

–Information about any kind of building works that could have been made on the property (new swimming pool, extensions, etc.)

Community of owners and IBI payments:

It´s important to ensure that at the time of the sale you are up-to-date on both payments for any community charges which affect your property and IBI (Council Tax) payments.

Contract draft:

Once our team at Fuster & Associates receive all the necessary documentation, we will draw up a contract of sale and purchase.

Our professionals will negotiate the terms with the buyer’s solicitor – completion terms, date, retentions and other matters – and, once a version of the contract has been agreed upon by both parties it will be sent to you for signing.

The completion date itself will be included on the draft contract.

Final break down:

Before completion you will be sent a final costs breakdown of your sale.

This document will list all taxes, fees and retentions connected to the sale.

The breakdown will also show you how much money you will receive from your sale after the payment of all associated costs

Completion date:

Completion date is when it all comes to a happy close!

The sales of your property in Spain takes place at the notary´s where you´ll received a banker’s draft and the keys of the property will be handed to the buyer.

On the completion date agreed, our team of solicitors will visit the Notary´s office either on your behalf through the previously signed Power of Attorney or accompanying you as your advisor and interpreter.

The Notary will authorise the title deeds before you receive payment.

Once this is done, a new Escritura – containing all the details of the sale and the change of ownership – will be issued.

Mortgage to cancel:

Should there be a mortgage against your property and the loan is set to be paid off at the time of sale – during the completion date at the Notary -, remember that all cancellation costs are generally the seller’s responsibility.

Taxes after selling your house in Spain:

After selling a property in Spain, vendors are liable for several taxes levied by different authorities.

The first of these is the so called Impuesto de Plusvalía or Municipal Land Tax which is calculated as a percentage of the change in value of the land on which your property stands.

This is owed to your local town hall and varies depending on the municipality.

Capital Gains tax:

When a non-resident sells a property in Spain, the buyer is obliged to retain 3% of the price and pay it to the tax authorities to cover the vendor’s tax liabilities.

This, however, does not increase the purchase price for the buyer.

Instead, they simply pay 97% of the agreed price to the seller and 3% to the tax office.

If no profit is made or the tax payable amounts to less than the 3% retention, the seller can ask Hacienda for a refund.

Bear in mind, though, that the tax authorities will not return any moneys until any outstanding tax bills (including income tax and wealth tax) are fully paid.

If the process sounds too cumbersome, remember that at Fuster & Associates we can easily arrange the reclaim of this 3% retention on your behalf while ensuring that you are up to date with your non-resident tax payments.

Other costs when selling a house in Spain

The rest of the costs arising from the sale and transfer of a property are usually the responsibility of the buyer.

These include:

- Fees at the Land Registry

- Transfer tax

- VAT

- AJD, or Impuesto sobre Actos Jurídicos Documentados (stamp duty)

- Other fees charged by the notary to draw up an “escritura” (title deeds) in the new owner’s name and officiate its signing.

Utilities contracts:

It is the obligation of the buyer’s solicitor to change all utilities´ contracts to ensure the continued supply after the sale of the property under the new buyer’s name.

Previous bills should be paid before completion.

Solicitors often agree to make a ‘utilities retention’ so that if there are any debts on utilities these will be covered by the amount retained.

Should there be no outstanding debts, the retained amount will be refunded in full.

[button title=” Request a free quote from Fuster” link=”https://fuster-associates.com/contact/” align=”center” icon=”” icon_position=”” color=”” font_color=”” size=”4″ full_width=”” class=”” download=”” rel=”” onclick=””]

Do you feel overwhelmed by the process?

Are the steps described above stressing you out?

Do you still have many questions even after reading this thorough guide?

At what price should you sell the house?

How would you best prepare it for the sale?

What Real Estate should you choose?

What bureaucratic procedures do you have to go through?

Who is going to carry out these procedures?

Being overwhelmed by this type of questions is normal.

You want to ensure the sale of your property in Spain goes on smoothly and you don´t encounter any problems neither during nor after the sale.

After twenty years´ experience in the sale of properties in Spain we know that one of the smartest and safest ways to face this complex process is not to travel alone. Travel with a team of people who can advise you every step of the way.

Fuster & Associates can point you in the right direction and recommend well-known, trusted Real Estate Agents in your area.

Our team of conveyancing solicitors will also ensure the sale of your property is an equitable process for all parties.

We will make sure you don’t assume unnecessary costs and that there are no gaps and errors made by third parties.

So you can close this chapter of your life without stress and looking forward to what lies ahead for you! Talk to us about your no obligation consultation!

Our professional team will take the appropriate steps towards ensuring that you meet all your Spanish tax and legal obligations when selling a house in Spain.

We want to help you navigate all the legal complexities that come with your home buying in Spain, but this article is legal information and should not be seen as legal advice.

- View more post about: Sales Conveyancing