2017 wasn’t just any year for consumers or banks. Quite the opposite: it will go down in history as the starting point for massive claims for due to abusive mortgage clauses. Abuses that flooded courts in all of Spain and among which we find the famous floor clauses, multi-currency loans or mortgage formalization expenses.

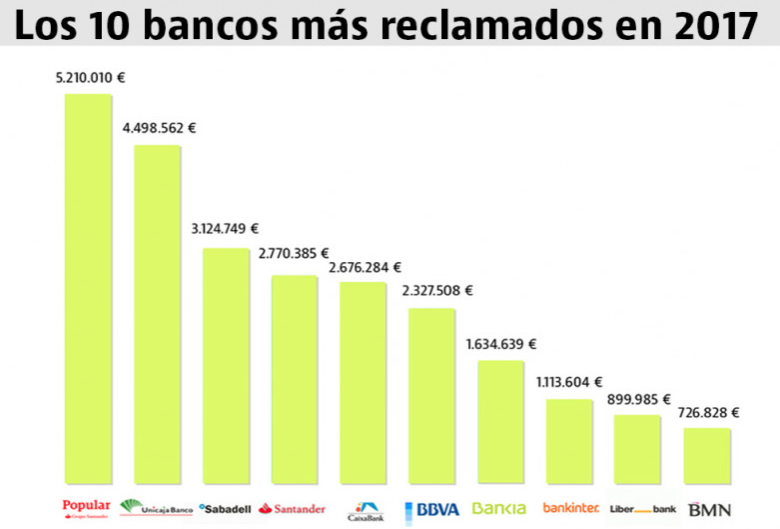

All these clauses took over most bank claims last year, which according to the calculations of reclamador.es, reached 25 million euros. That is the amount that users demanded only from the 10 most claimed entities. Due to a hidden floor clause in your Spanish mortgage, you could be entitled to claim thousands of overpaid interest. Based on new rulings by the European Court of Justice, if you have taken out a Spanish mortgage then you may be entitled to a refund for overpaid interest caused by a hidden floor clause (cláusula suelo) in your mortgage agreement.

The worst halt was Popular, for which 2017 became the most difficult year in its history. In June, it fell into the hands of Santander Bank for the symbolic price of one euro after European financial institutions declared it insolvent after nearly a century of activity. The most claimed entity in the country, with 5.21 million euros, joins it. Thus, one out of every five euros that those affected demanded from a bank, had Popular behind it.

The second most claimed entity was the Unicaja Group, with 4.49 million euros; followed by Sabadell (3.12 million), Santander (2.77 million), Caixabank (2.67 million), BBVA (2.32 million), Bankia (1.63 million), Bankinter (1.11 million), Liberbank (899,985 euros) and BMN (726,828 euros).

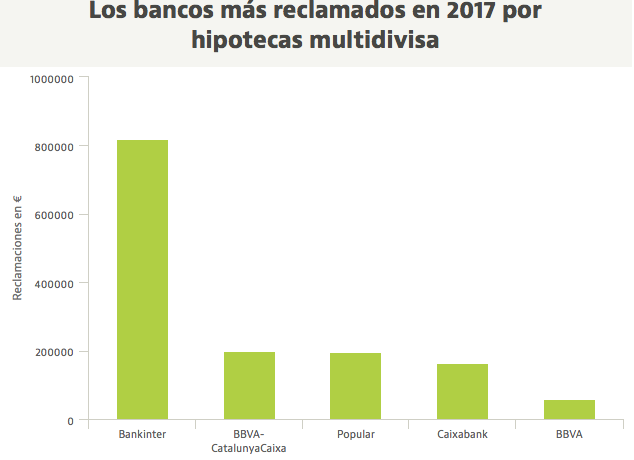

But each bank had its problems. Bankinter’s great burden, for example, were multi-currency mortgages (signed in non-euro currency), whose total claims reached more than 800,000 euros out of a total of 1.11 million euros. However, for Popular it was less than 200,000 euros and for BBVA, less than 60,000 euros.

The most claimed banks due to multi-currency mortgages in 2017

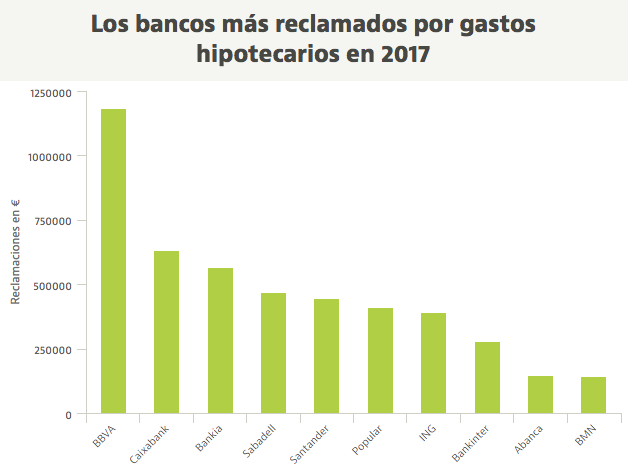

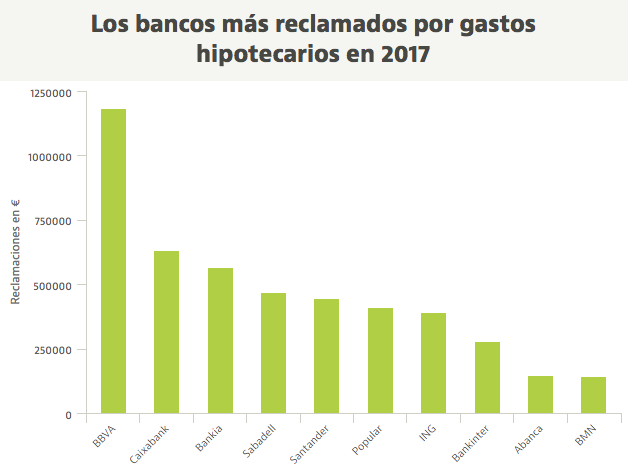

On the other hand, the entity led by Francisco González led the ranking of the most claimed banks for mortgage formalization, with 1.18 million euros for this concept. This amount far exceeded those demanded by those affected by Bankinter (around 278,000 euros) or Popular (around 411,000 euros).

The most claimed banks due to mortgage expenses in 2017

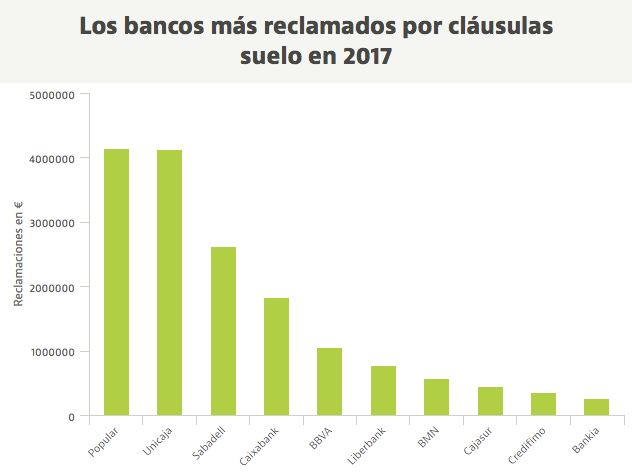

So why did the latter head the claims ranking? The answer lies in the famous land clauses, which undoubtedly became his Achilles heel with 4.14 million euros in claims. They were closely followed by the Unicaja Group, made up by the Unicaja Bank and its subsidiary EspañaDuero, out of the 4.5 million claimed in total.

Sabadell, with 2.62 million; Caixabank, with 1.83 million; and BBVA, with 1.05 million, complete the top five banks which received the most claims from consumers due to the most famous abusive mortgages clauses.

- View more post about: Purchase Conveyancing, Sales Conveyancing